Retire with Purpose. Not just a Plan.

4 Office Locations

Over 1,100 Clients Served around the U.S.

100+ Years Combined

Financial Expertise

Your Retirement. Your Legacy.

Your Epic Life.

Retirement isn’t the end of the road—it’s your next EPIC beginning!

We believe in designing a retirement plan that reflects your goals, your lifestyle, and your legacy. In today’s world—with rising taxes, market volatility, and longer lifespans—winging it just isn’t an option.

You don’t need a cookie-cutter plan.

You need a strategic, tax-smart, lifestyle-focused roadmap that evolves with you.

The Epic Retirement Roadmap was designed to answer the questions we all have:

HOW MUCH money will I need to retire?

WHEN can I retire?

WHAT will my taxes be in retirement?

WHICH option should I choose for my Social Security?

Do you understand the ways taxes could impact your retirement?

Schedule today and receive a complimentary Taxes in Retirement Report—a detailed estimate of what you could pay in taxes during retirement.

National

Recognition:

Free Epic Resource

"What to Consider Before I Retire"

Before you book the cruise, buy the lake house, or finally hand in that retirement notice—let’s make sure you’ve checked all the right boxes.

Our “What to Consider Before I Retire” checklist is designed to give you clarity, confidence, and control as you prepare for your next epic chapter.

This isn’t just a list. It’s a strategic tool to help you:

Understand the financial foundations you must have in place

Identify gaps that could cost you in taxes or income down the road.

Prioritize lifestyle, legacy, and long-term security

Start having better, more focused conversations with your advisor or spouse

Because your next chapter deserves a smart beginning.

With our EPIC retirement strategy, clients benefit from expert planning, proactive tax solutions, investment guidance, and complete financial care.

Retirement income & portfolio management

Social security plannning

required minimum distributions

pension

legacy & Estate planning

irmaa-medicare

tax optimization

long - term care

lifetyle & goal setting

Gold vs. Stocks: Should You Really Bet Your Retirement on Gold?

Written by: Greg Stapleton, Associate Wealth Advisor

Let’s talk about...Gold.

Throughout history, gold has been a constant symbol of wealth, power, and high status. From Egyptian pharaohs to the Roman Empire, gold has shaped civilizations, fortified economies, and been used as the standard of wealth in trade, monetary systems, and even modern central banks.

With all the uncertainty in the market, you might be wondering if it’s time to sell your investments and put your money into gold. It’s often pitched as a safe haven investment, especially for retirees looking to protect their wealth. But is that really the best move?

Let's looking at how gold has performed compared to the stock market, why some companies push gold so aggressively, and what you should consider before making any big investment changes.

Gold vs. S&P 500 Performance

Gold is often seen as a store of value and is often called a “hedge against inflation,” but how does it actually perform over time? Let’s look at the numbers.

Since 1992, gold has grown at an average annual rate of 5.44%. Meanwhile, the S&P 500 has returned 11.27% per year. This means that $10,000 invested in gold in 1992 would be worth about $79,638 today, while the same amount invested in the S&P 500 would be worth $278,348.

Simply put, the growth of the price of gold is extremely low compared with stocks. Because of this, buying gold as an investment does not make sense for most investors. Investing in stocks can produce better results, be more readily available to use, and allows for more diversified options. It provides a better hedge against inflation than gold.

Why Gold-Selling Companies Target Retirees

Hedge against inflation

Stability in harsh economic environments

Protect your hard-earned money by investing in value

Worldwide economic meltdown

Invest in safety

Prevent politicians from devaluing your hard-earned money

These companies highlight fears of inflation, market crashes, and government intervention, often suggesting that traditional investments are too risky. While protecting your retirement is important, it’s also essential to recognize what the tactics they use are trying to do: create an emotional response. Once they have triggered an emotional response, these companies give you the “only” solution: their product.

I have a personal family story about this. In his retirement, my grandfather often listened to a radio talk show that heralded the benefits of buying gold. After a tumultuous year in the US economy, he was told by the talk show host that NOW was the best time to buy gold. He was concerned with the direction of the country, and decided he wanted to try and protect what he had worked so hard to earn.

He didn’t have many liquid assets, so my grandpa decided to take out a reverse mortgage on his home and buy a large portion of gold.

His investment in gold ended up being very poorly timed. He bought the gold at a very high point in the market and proceeded to lose a good portion of the value of his investment soon thereafter.

Though there are various messages you could take away from this story, I want to focus on one in particular: don’t make investment decisions based on emotions.

Every bit of sound investing advice mentions this. Emotional reactions lead to poor investment decisions. My grandpa made a large decision based on an emotional response to the radio show’s content, and it led to some poor outcomes.

Companies selling gold usually target individuals most interested in protecting their money: retirees. That’s why most commercials selling gold are on news channels and during daytime news shows. Who will be watching the news during the day? Retirees.

Don’t fall into their trap! Now that you know their game plan, you’ll be able to be unaffected by their emotionally charged commercials and messages.

Things to consider when making a decision

There are some important things to keep in mind when considering buying gold or other precious metals as an investment: liquidity, sales fees and markups, and the probability of a doomsday event.

Liquidity is one of the major considerations in valuing stock investments over gold. Most companies offering their services to buy and sell gold are doing so with physical gold. Selling the gold you are holding can only happen by finding a buyer (another individual, a pawn shop, or gold buying companies, usually), negotiating the price, and then executing the sale. As you can probably imagine that process could take a while.

Selling investments held in a retirement account, on the other hand, is simple and fast. If an emergency arises and you need to sell your investments to use as cash, you can access those funds almost immediately.

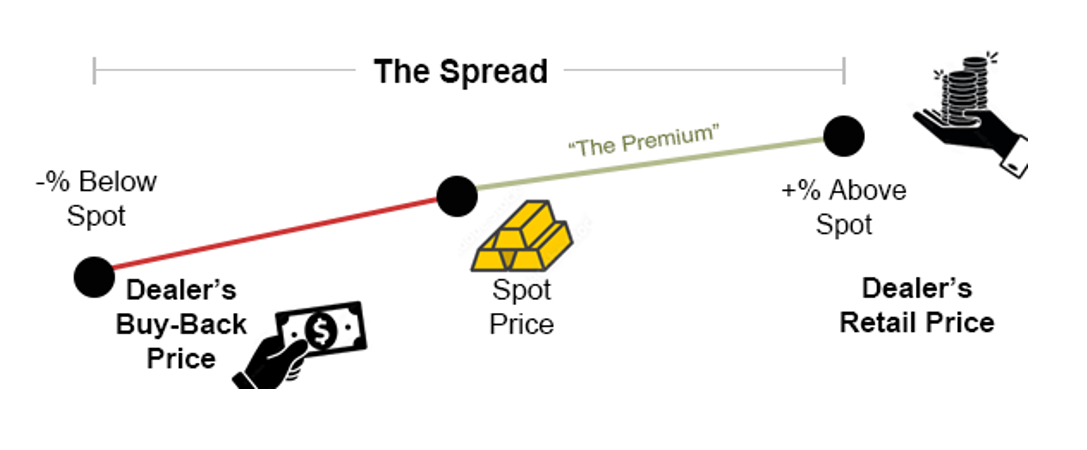

One of the least discussed drawbacks to purchasing and selling gold are the sales fees and markups. Sales fees, commissions, dealer markups, transaction fees, etc. are all well-known and rarely discussed parts of buying and selling gold. There is almost always going to be a fee that will be paid to the dealer, buying, or selling individual of each transaction.

A dealer will always sell precious metals above the spot price (aka market price) and buy it back below the spot price. The difference between the dealer’s buy and sell price is known as the dealer’s spread. Here is a great visual aid to show how the spread works:

(https://www.finra.org/investors/insights/buying-physical-gold-or-other-metals)

Many investors cite a doomsday event as motivation for buying gold. The mindset is that if a catastrophic, life altering event were to occur and the companies whose stock you own are suddenly worthless, gold would hold value enough to use as a type of monetary system.

The likelihood of this type of event occurring is minuscule. If I thought this were likely, I would have chosen a different career to pursue. Yet this is the message that advertisers use to trigger panicked buying of gold by vulnerable retirees.

Gold isn’t a bad investment—it’s just not a complete investment strategy. It can be useful as a small percentage of a diversified portfolio, if that aligns with your individual values.

Final Thoughts

So, should you sell your stocks to buy gold? Probably not—at least. A balanced portfolio that includes stocks, bonds, and other assets gives you flexibility, growth potential, and financial stability. If you’re considering gold, it should be a thoughtful decision, and definitely not one driven by fear.

And if you decide to make gold a small part of your investment strategy, make sure to do your research, avoid high-pressure sales tactics, and focus on a long-term strategy that aligns with your financial goals.

If you found this helpful, be sure to subscribe for more insights on investing and financial planning. And let me know in the comments—what are your thoughts on gold as an investment?

Awards Disclosures:

Companies on the 2024 Inc. 5000 are ranked according to percentage revenue growth from 2020 to 2022. To qualify, companies must have been founded and generating revenue by March 31, 2020. They must be U.S.-based, privately held, for-profit, and independent – not subsidiaries or divisions of other companies – as of December 31, 2021. (Since then, some on the list may have gone public or been acquired.) The minimum revenue required for 2020 is $100,000; the minimum required revenue for 2024 is $2 million. As always, Inc. reserves the right to decline applicants for subjective reasons. Firms must submit an application in order to be considered. No compensation was paid by the firm to be considered. The award was received on August 15th, 2023.

“USA TODAY’s Best Financial Advisory Firms 2024” was published on April 23, 2024, and is a ranking of registered investment advisory firms prepared by USA Today and Statista, Inc. The ranking is based on recommendations by financial advisors, clients and industry experts and a firm’s development of Assets Under Management (AUM). Recommendations were collected via an independent survey among over 25,000 individuals, and self-recommendations were prohibited. In order to be eligible, firms must be registered as an RIA firm with the SEC or at state level for at least one year, a principal office in the United States, a clean disciplinary record, offer financial planning services or portfolio management for individuals and/or small businesses, AUM must be greater than $500,000 and achieved an overall score among the top 500. No compensation was paid in order to be eligible for this award.

Disclosure:

All Investment Advisory Services are provided by Epic Trust Investment Advisors, LLC d/b/a Epic Private Wealth, an SEC Registered Investment Advisor. Registration with the SEC does not imply a certain level of skill or expertise. Insurance products are offered through Northwest Insurance Alliance, LLC and guarantees are subject to the claims-paying ability of the issuing company and are not guarantees offered by Epic Trust Investment Advisors, LLC, or its affiliated companies. Epic Trust Investment Advisors, LLC d/b/a Epic Private Wealth is NOT a chartered bank, trust company, or depository institution. Additional information about Epic Trust Investment Advisors, LLC d/b/a Epic Private Wealth, is available in its current disclosure documents, Form ADV Part 1A, Form ADV Part 2A Brochure, and Client Relationship Summary report which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using SEC #801-120618. Epic Trust Investment Advisors, LLC does not offer or provide legal or tax advice. Please consult your attorney and/or tax advisor for such services.

Epic Trust Is A Client-Focused SEC Registered Investment Advisory Firm That Offers It's Network Investment Advisor Representatives Access To "Proven In The Trenches" Financial Planning Tools and Investment Portfolios Tailored To Each Client’s Unique Goals And Plans. Please note, registration with the SEC does not imply a certain level of skill or expertise.

No client or potential client should assume that any information presented or made available on or through this website should be construed as personalized financial planning or investment advice. Personalized financial planning and investment advice can only be rendered after engagement of the firm for services, execution of the required documentation, and receipt of required disclosures. Please contact the firm for further information.